It’s September...school’s back in session and summer is over. And, if you’re thinking about buying or selling a home this fall then be sure to review our insights below as we discuss current market trends as well as what to expect over the next several months.

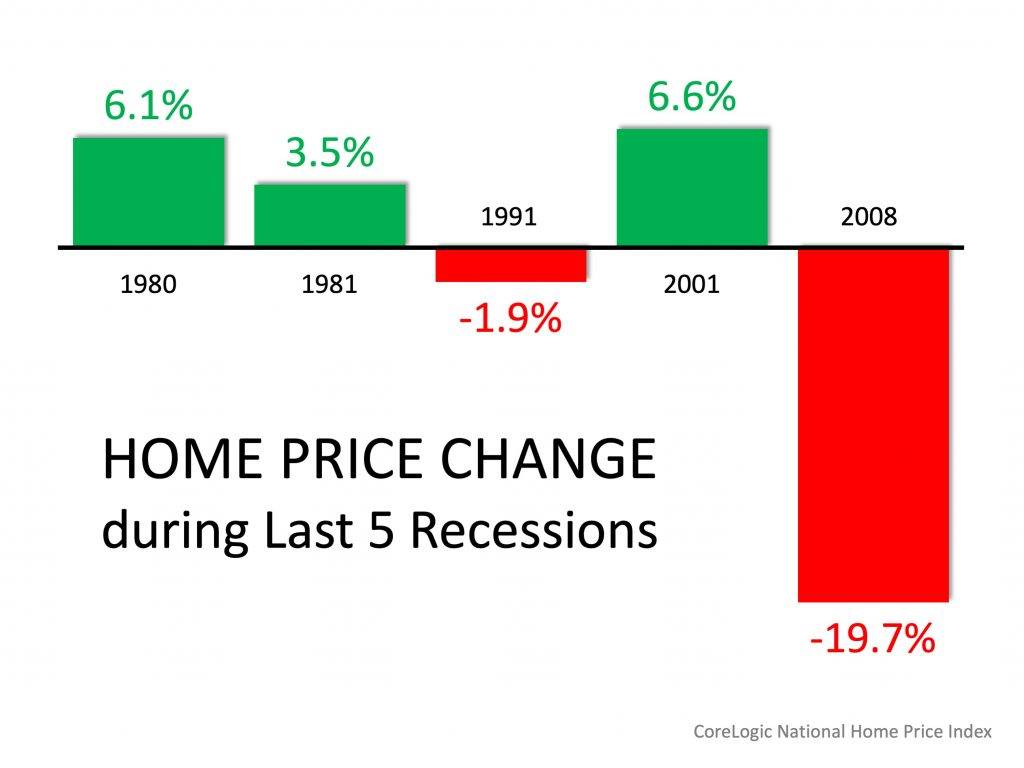

Let’s start off discussing what’s been top-of-mind lately, like how an impending recession may lead to another housing crisis likened to what we saw in 2008. Well, let’s take this opportunity to dispel these fears. Although a slowdown in the economy in 2020 is being predicted, this time around housing will not be the cause of the slowdown, and more likely, home values will actually continue to trend upward. In fact, home values actually increased in three (3) out of the last five (5) recessions, and decreased by less than 2% in the fourth (4th).

The main reason we saw a major housing crash during the last recession in 2008 was from the mortgage meltdown and the subsequent housing market crash that caused it. For more information about this topic, check out my recent video “Does a Looming Recession Equate to a Housing Crisis?”

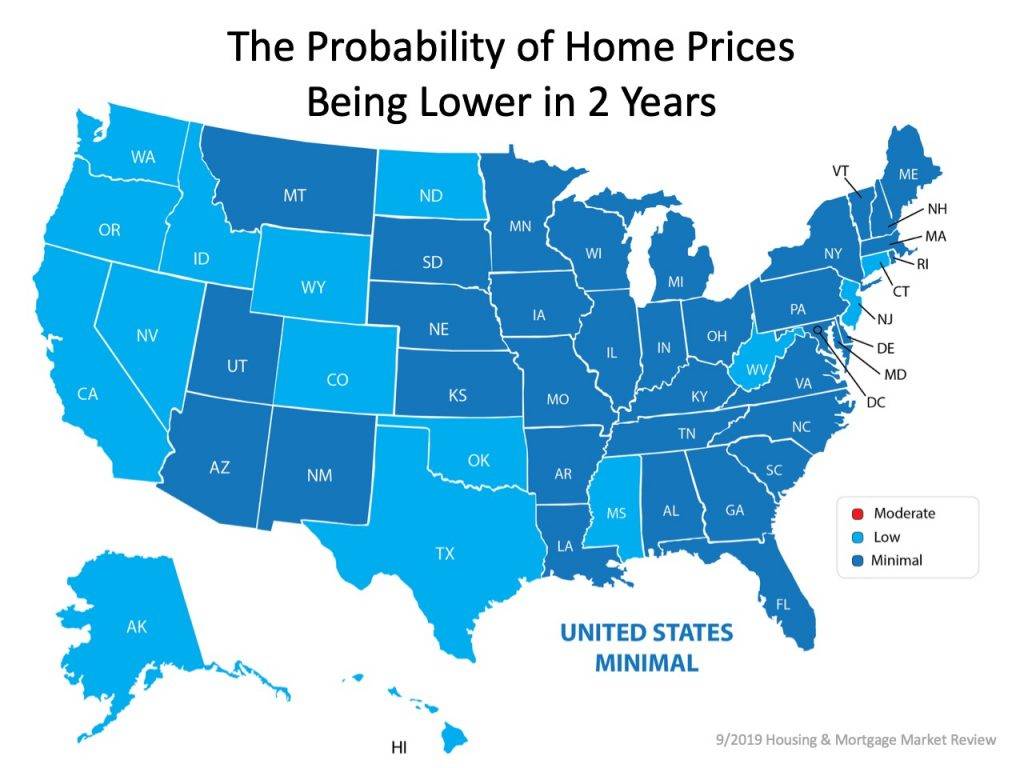

Looking at national housing prices, if a major housing crash were on the horizon, wouldn't you expect to see prices falling from last year?

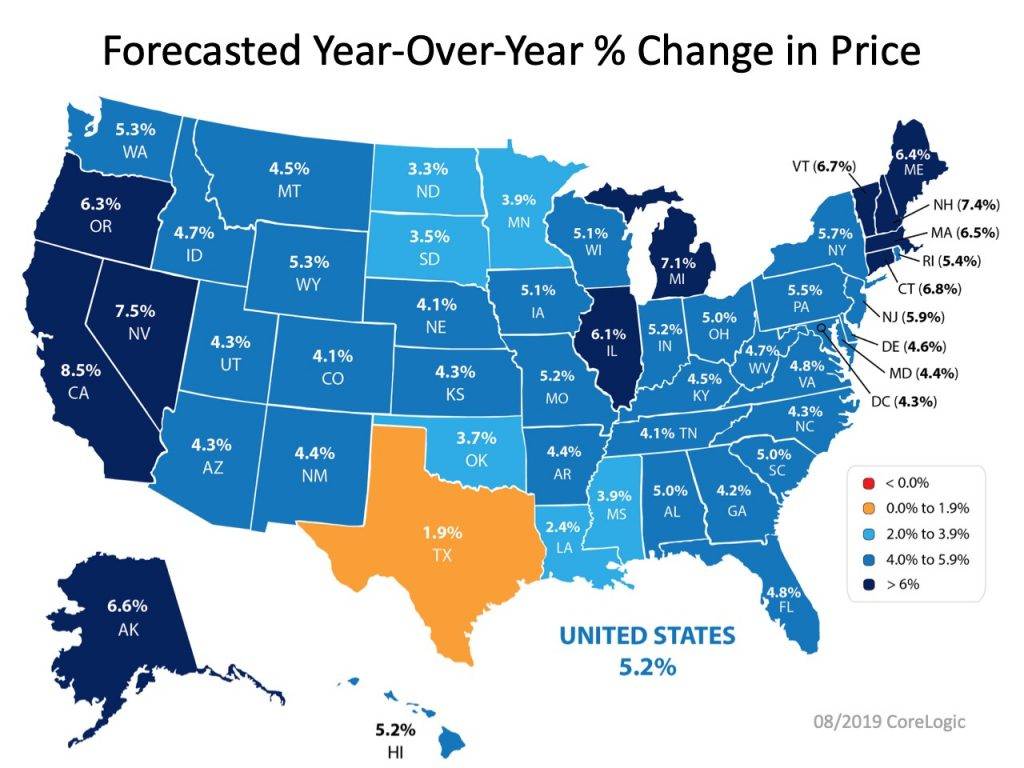

Well, we’re actually seeing good growth across the US as August reported that home prices grew 4.99% nationally compared to last year. Drilling down closer to home, in the Pacific Region of the country, our year-over-year home price appreciation reported to be 4.4%; and even closer to home, Statewide for California we saw a little less price growth with a 4.2% increase.

With these positive numbers, so far it appears that our economy is still strong enough to support growing homeownership rates. And, looking forward, even in the eyes of a slowing economy, the national housing market is actually expected to gain 5.2% appreciation through next year, with California expected to see as much as an 8.2% increase in prices year-over-year.

What’s causing all the positive price growth?

Well, the Federal Reserve is actively combating our recession woes by continuing to ease interest rates which are helping long-term mortgage rates stay low, even recently hitting historic lows not seen since 2016. This is great news as lower mortgage rates help increase purchase power and affordability, something which Bay Area residents can really celebrate.

Now let's look at the current supply and demand here in San Jose, and compare against last month and last year.

Total ACTIVE inventory was down again for the month of August with 1,126 TOTAL homes available for sale, a decline of 8% from July, but up 1.5% from the same time last year. And, the number of New Listings, which provide us a glimpse into rising or declining listing activity, was also just slightly down by 2.5% from July coming in at 777, but down over 13% from the same time last year...

Now for Buyer Demand...with mortgage rates at or near historic lows, we’d hope to see demand stabilizing. And, with August reporting a slight decline of 2% from last month with 676 Total Closed Sales, and a total of 627 homes receiving a contract, also slightly down from last month, I think we are seeing just that. Plus, Freddie Mac’s Chief Economist recently reported that Homebuyers flocked to lenders in August with purchase applications, which were up 15 percent from a year ago.

So, as long as pending sales, which are being driven by lower rates and softening housing prices, continue to keep up with new listings, we should continue to see a very stable and balanced market.

Median Days that a property is on the market before receiving a contract was 19 days for August, up slightly from the month before, but overall, anything less than 30-days is still a great market. And, the Median Sales-to-List-Price ratio, which compares the sales price received for a home versus its asking price, was slightly down for August compared to last month, reporting at 100.2%...so, on average, homes are still expected to sell for slightly more than the listing price.

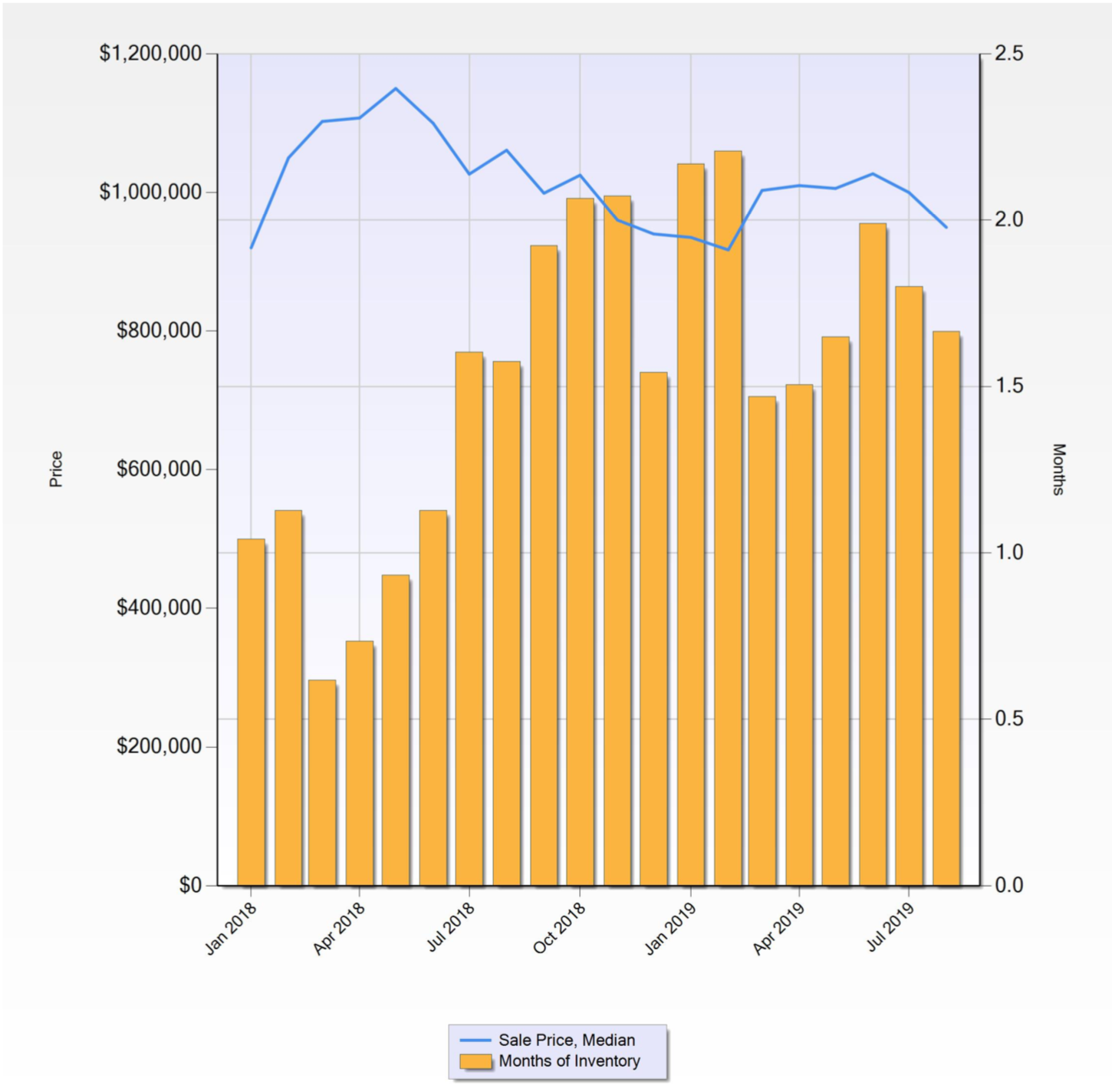

Our Median Sales Price this month is continuing on a slight downward trend, dipping to $949,500, down 5% from last month, and down 7.5% from our peak earlier this year in June.

But, our prices are still up 2% from the beginning of the year.

So, have we reached a price-plateau...maybe? The Median Sales Price has been holding pretty steady since last fall.

So, what are these market trends telling us?

The best indicator of what to expect comes from looking at the current month’s worth of supply which measures how quickly new listings are absorbed by the current level of buyer demand, which for August was just under 2.0 months.

As you may recall, anything under 6-months worth of supply is considered a seller’s market. Although it may not exactly feel like a seller’s market around the Bay Area, as home sellers have unbelievably become accustomed to homes selling at 10-15% above their asking prices within days of being listed, that’s because we’re finally settling into a more balanced market.

So, for anyone looking to sell this Fall, conditions are still in your favor but you must adjust your expectations as the market is not as crazy as it was...your home must be priced appropriately if you wish to generate the interest levels necessary to sell quickly and at a good price. Market changes always seem to insight fear since things stop behaving exactly how they have been. And with all the negative headlines predicting a looming recession, it’s no wonder why many homebuyers are sitting on the sideline waiting to see what happens.

Well, this is a wake-up call to all homebuyers...don’t miss the opportunity to lock in a very low housing payment and a very reasonable price. The market hasn’t looked this good for first-time homebuyers and move-up buyers in a long time.

So, if you’re still considering a move into your first home or your next home, and you haven’t updated your pre-approval in a few months, it’s a great time to find out how these low rates have improved your purchase power.

FEATURED LISTINGS

- 3DActive

$1,350,000

9.05 Acres0000 Palm AVE, Morgan Hill, CA 95037

Vacant Land

Listed by Brad Gill of NextHome Lifestyles

- 3DActive

$1,450,000

10 Acres0000 Palm AVE, Morgan Hill, CA 95037

Vacant Land

Listed by Brad Gill of NextHome Lifestyles

- 1/41 41Active

$2,988,000

23.7 Acres20011 Graystone LN, San Jose, CA 95120

Vacant Land

Listed by Brad Gill of NextHome Lifestyles